Archive

| Release | Date |

|---|---|

| 21.4 Critical Patch | March 1, 2022 |

| 21.4 Major Release | January 8, 2022 |

| Encompass 21.3 Critical Patch 2 | December 16, 2021 |

| 21.3 Critical Patch 1 | December 14, 2021 |

| 21.3 Major Release | October 2, 2021 |

| 21.2 Major Release | June 5, 2021 |

| 21.1 Service Pack | April 15, 2021 |

| 21.1 Major Release | February 23, 2021 |

| 20.2 Service Pack | January 21, 2021 |

| 20.2 Service Pack | December 17, 2020 |

| 20.2 Major Release | November 23, 2020 |

| 20.1 Service Pack | September 22, 2020 |

| 20.1 Service Pack | August 18, 2020 |

| 20.1 Critical Patch | June 6, 2020 |

| 20.1 Service Pack | May 23, 2020 |

| 20.1 Major Release | April 25, 2020 |

| 19.4 Service Pack | January 18, 2020 |

| 19.4 Major Release | November 16, 2019 |

| 19.3 Major Release | August 22, 2019 |

| 19.1 Major Release | February 19, 2019 |

| Older Release Notes |

21.4 March Critical Patch

The changes made with the Encompass Developer Connect and Encompass eClose 21.4 March Critical Patch impact clients using the Encompass eClose workflow. There is no new version of Encompass for clients to download.

eClose

Values on LE/CD Total of Payments

An issue existed where loans with financed MI had different values on LE/CD total of payments if generated through eClosing or Developer Connect API vs Encompass. This issue is resolved.

UCD Export

This critical patch also provides an update to V1 Get Loan formats for export.UCD and export.UCD.Final to comply with the UCD Mandate scheduled for March 31, 2022. This will be available for clients leveraging Developer Connect for UCD Automation with this release.

Note: The updates for UCD will not be available on Encompass Smart Client until March 10, 2022.

EBSP-37531. EBSP-36976, EBSP-37531

21.4 Major Release

Announcements

UI Enhancements and Faster Page Loading

With this release we have adopted a new UI framework for the portal. You will see minor formatting changes throughout, but more importantly faster page loading!

Try It Support for 18 Languages

The Try It feature has been enhanced to generate code in 18 different languages:

C, C#, C++, Clojure, cURL, Go, Java, JavaScript, Kotlin, Node, Objective-C, oCaml, PHP, PowerShell, Python, R, Ruby, and Swift.

Retirement of Language Bindings

The .NET Language Bindings are being retired with this release. ICE Mortage Technology will continue to support them.

Webhook Update

In order to standardize communications from the Webhooks platform, all webhook event type names across all products were converted to lowercase. With this change, all client and partner webhook subscriptions remain intact and functional.

Example: Before

"eventId": "03d3ed0e-9932-4d68-b364-e95ffafc8757",

"eventTime": "2022-01-25T22:39:50.733Z",

"eventType": "Update",

Example: After

"eventId": "03d3ed0e-9932-4d68-b364-e95ffafc8757",

"eventTime": "2022-01-25T22:39:50.733Z",

"eventType": "update",

Best Practice

As a best practice, and for customers seeing a difference post adoption of 21.4, we recommend doing a case-insensitive string comparison when condition checking webhook event JSON string values.

const RESOURCE = 'loan'; // declared as lowercase

const EVEN_TYPE = "update"; // declared as lowercase

let eventHookEvent = {

"eventId": "03d3ed0e-9932-4d68-b364-e95ffafc8757",

"eventTime": "2022-01-25T22:39:50.733Z",

"eventType": "update",

"meta": {

"userId": "user",

"resourceType": "Loan",

"resourceId": "b9b45c4c-abfa-445f-9829-fca448825014",

"instanceId": "bexxxxxxxx",

"resourceRef": "/encompass/v3/loans/b9b45c4c-abfa-445f-9829-fca448825014"

}

};

/*

in the middle of the code to see the right event type

*/

if (eventHookEvent.eventType.toLowerCase() === EVENT_TYPE) { //Note we are doing case insensitive compare

}

Enhancements and Fixes

Loan Management

V3 Create Loan API: New Action Attribute Applies TPO Loan Originator Information to URLA 2020 Loans

The V3 Create Loan API has been enhanced to support a new TPO Action: tpoRegister. When the tpo.loId and loId query parameters are passed with action=tpoRegister, the tpo.loId value will be applied as the Loan Officer in the resulting loan.

EBSP-33614

V3 Update Loan API: Two New TPO Actions Available

The V3 Update Loan API has been enhanced to support the following new TPO actions:

- tpoOrderAppraisal. Orders an appraisal for the specified loan.

- tpoGenerateDisclosures. Generates LE/Disclosures for the specified loan.

PATCH /v3/loans/{loanId}?action=tpoOrderAppraisal | tpoGenerateDisclosures

EBSP-33303, EBSP-33302

Loan: Field Lock Data

New Field Lock Data API Available

A new Field Lock Data API is available for managing the list of locked fields in a loan. Previously, the list of fields in the fieldLockData was being replaced on each Update Loan API call. With this API, the fieldLockData collection is treated as an appendable collection rather than replacing on each call. This API is particularly useful in scenarios where a field needs to be removed from the list of locked fields.

PATCH /v3/loans/{loanId}/fieldLockData?action=add | remove | replace

EBSP-18967

Send Encompass Docs

Opening Doc Set API Supports Encompass Forms

The Send Encompass Docs API suite has been enhanced to support the ability to add additional Encompass forms to an existing opening doc set. Previously, only eFolder documents could be added to an existing opening doc set.

NDE-17613

Loan: Disclosure Tracking 2015

New Attribute Added to Disclosure Tracking API Contract

A new UseForUCDExport attribute has been added to the V1 DisclosureTracking2015 contract (read-only) and V3 EnhancedDisclosureTracking logs (read-only) for Closing Disclosure logs. This attribute indicates whether the Closing Disclosure is selected as the disclosure to send for UCD (Uniform Closing Dataset) to Fannie Mae or Freddie Mac.

EBSP-33974

eFolder: Document

Behavior Change for StatusBy/StatusDate Attribute Sets in Update Document API Contract

A change has been made to how the values for receivedBy/receivedDate and requestedBy/requestedDate attribute sets behave when updating a document. This change applies to V1/V3 Update Document APIs.

EBSP-33423, EBSP-33422

eFolder: Attachments

Update Attachments Successfully on Locked Loans

The V1/V3 Update Attachments APIs were enhanced to allow attachments to be updated on loans that are locked. The remove action will continue to return a 409 Conflict error when the loan is locked.

EBSP-33420

EstimatedClosingDate Value Now Retained when Rate Lock is Confirmed

A change has been made to the V1/V3 Rate Lock APIs to resolve an issue that prevented the estimatedClosingDate value from being retained when a lock is confirmed.

EBSP-33442

Encompass 21.3 Critical Patch 2

The Encompass 21.3 Major Release Critical Patch 2 was released on December 16, 2021 for the year-end updates recently announced government agencies. In addition to the updates described in the Encompass release notes, the following updates will be provided when you upgrade to Encompass version 21.3.0.2.

Settings: External Users

Resolved Issue with Get External User API

An issue has been resolved that caused the Get External User API to fail with a bad request if the specified TPO userID started with “0”.

EBSP-27694

Loan: Rate Lock

Null Values Now Retained in the Request Payload for Certain Fields

Updates were made to the V1 Rate Lock APIs to retain empty/null values when the following fields are passed in the request payload: Sell Side Fields, Buy Side Fields, Comparison Fields, Loan information.

EBSP-33309, EBSP-33310

eFolder: Attachments

Resolved Issue that Caused V3 Attachment API to Fail with a “CheckAttachmentXmlVersion” Error

Some lenders experienced the following error when attempting to upload an attachment via the API:

“Create Attachment failed. Please try again. Message: Couldn't read latest version of Attachment xml file.”

This error occurred with loans that had a mismatched value for FileSequenceNumber between attachments.xml and the corresponding value in the DB. This issue has been resolved.

EBSP-33185

Loan: Management

V3 Loan Management Endpoints Now Return Loan Item IDs When View=id is Passed

When the calling the V3 Update Loan API with the view=id query parameter, the ID of the loan item was returned in the response instead of the Loan ID. For example, when calling:

PATCH /v3/loans/{loanId}/investorDeliveryLogs?action=add&view=id

The Investor Delivery Log ID was being returned instead of the Loan ID.

This issue has been resolved and when view=id is passed with Update Loan, the Loan ID is now returned in the response.

EBSP-32029

December 21.3 Critical Patch 1

Resolved Issue with Opening Disclosures Not Being Attached and Assigned when Ordered Through the Send Docs API

An issue existed where opening disclosures retrieved in the eFolder were not being attached automatically to the correct document if they were ordered through the Send Docs API. When users clicked the Retrieve button in the eFolder, the opening disclosure files were displayed in the Unassigned section of the File Manager. With this issue, the Auto Assign function also failed to automatically assign these files to the appropriate eFolder document.

This issue was resolved and now opening disclosures ordered through the Send Docs API are being attached and assigned correctly.

NDE-19587

Resolved Webhook Issue with DocumentOrder Events Not Being Received at Subscription Endpoint

An issue was resolved with the Webhook subscription for DocumentOrder events that prevented API calls for opening and audit events (e.g. openingordercompleted, openingauditcompleted, openingauditfailed, and so on) from being received at the subscription endpoint. With this issue, the API call completed asynchronously as expected, however, the webhook event was not being sent.

This issue has been resolved and DocumentOrder events are now being received at the subscription endpoint as expected.

NDE-19587

October 21.3 Major Release

New and Updated V3 APIs

New V3 APIs for Disclosure Tracking 2015 Logs

With this release, we are introducing V3 APIs for retrieving and managing Disclosure Tracking 2015 Logs. Use these APIs to retrieve and manage log tracking entries for the 2015 Loan Estimate, Closing Disclosure, Settlement Service Provider, and Safe Harbor disclosures.

Endpoint URL: /v3/loans/{loanId}/disclosureTracking2015Logs

The following APIs are available for retrieving and managing Disclosure Tracking 2015 Logs:

- Get All Disclosure Tracking Logs. Retrieves all disclosure tracking logs for a specified loan.

- Get a Disclosure Tracking Log. Retrieves the specified Disclosure Tracking 2015 log for the specified loan.

- Add a Disclosure Tracking Log. Adds a disclosure tracking 2015 log to a specified loan.

- Update a Disclosure Tracking Log. Updates an existing disclosure tracking 2015 log on a specified loan.

- Get all Snapshots. Retrieves snapshot data for all the Disclosure Tracking logs for a loan.

- Get a Snapshot. Retrieves a snapshot of a specified Disclosure Tracking log.

EBSP-26777, CBIZ-38716

New API Available for Viewing Eligible Roles for an Encompass User

The Eligible Roles API provides the ability to retrieve a list of roles that an Encompass user qualifies for based on their persona and user group affiliation.

Endpoint URL: /v3/users/{userId}/eligibleRoles

EBSP-28617

New APIs Available for Managing Registration Logs

Use the Loan Registration Log APIs to create and manage registration logs programmatically when loans are registered.

Endpoint URL: /v3/loans/{loanId}/registrationLogs

The following APIs are available to manage registration logs:

- Get Registration Logs. Retrieves all registration logs for a loan.

- Create Registration Log. Use this API to create a registration log for an existing loan

- Update Registration Log. Updates an existing registration log.

EBSP-29357

New Field Writer API Available

The Field Writer API updates the values of fields by Field IDs rather than JSON paths for a given loan. This is an alternative to the Update Loan API, and is especially helpful when trying to update specific fields by field IDs. This API also provides the ability to lock and unlock padlock fields.

Endpoint URL: /v3/loans/{loanId}/fieldWriter

The following Field Writer APIs are available with this release:

- Update Loan Field Values. Updates field values for a specified loan file.

- Manage Field Lock Data. Adds or removes field lock data.

EBSP-31551

New APIs Available for Retrieving and Applying Funding Templates

A new API has been added to the Settings: Secondary API set to retrieve a list of funding templates, and the Loan API has been expanded to support the ability to apply a funding template to an existing loan.

Get Funding Templates

The new Get Funding Templates API has been added to the Settings: Secondary API set. It retrieves a list of funding templates available on the Encompass instance.

Endpoint URL: /v3/settings/secondary/fundingTemplates

Use the itemizationType query parameter to filter the results. Possible values are 2009, 2010, and 2015.

GET /v3/settings/secondary/fundingTemplates?itemizationType=<2009|2010|2015>

Apply a Funding Template to an Existing Loan

The Update Loan-1 templateType query parameter has been enhanced to support a value of funding. Use this value to apply a funding template to an existing loan.

PATCH /v3/loans/{loanId}?templateType=funding&templatePath={URI encoded template name}

EBSP-31601

Updates to the Investor Template API Contract

The Investor Template API contract has been updated to include a new purchaserTypeValue attribute. This attribute provides a long form value of the purchaserType field. The purchaserTypeValue attribute is passed between Loan APIs and populates Type of Purchaser (field ID 1397) in the HMDA Information form when the investor template is applied to a loan file.

The table below displays the possible values for the purchaserTypeValue attribute and the correlative purchaserType values:

| purchaserTypeValue (Long Form) | purchaserType (Enum) |

|---|---|

| Loan was not originated | NotApplicable |

| FNMA | FannieMae |

| GNMA | GinnieMae |

| FHLMC | FreddieMac |

| FAMC | FarmerMac |

| Private Securitization | PrivateSecuritizer |

| Savings Bank | CommercialSavingsBankOrAssociation |

| Credit union, mortgage company, or finance company | CreditUnionMortgageOrFinanceCompany |

| Life Insurance Co. | LifeInsurance |

| Affiliate Institution | AffiliateInstitution |

| Other type of purchaser | Others |

EBSP-29124

New and Updated V1 APIs

New Sell/Comparison Update Action Added to Submit Rate Lock API

The Submit Rate Lock API has been enhanced to support the update Sell/Comparison action. Use this action to update only the Sell Side and Comparison Side details for a lock that was previously confirmed, expired, or denied. This action creates a new lock snapshot, inheriting the attributes from the original lockId for lockRequest and buySide. The status of the original lock that you are updating is carried over.

POST /v1/loans/{loanId}/ratelockRequests?action=updateSellComparison&lockId={lock ID}

Enhancements Made to Lock Request Type in Rate Lock APIs

Enhancements have been made to the Rate Lock APIs to give clients the ability to distinguish between lock requests for active, expired, or cancelled locks. When attempting to relock a lock ID, the current status of the lock will determine the lock request type for the new lock request. If it is an active lock, the request type will be “LockUpdate”. If the lock is cancelled or expired, the request type will be “Re-lock”.

EBSP-31261

Enhancements Made to EPPS APIs to Return APR Details

EPPS API contracts have been updated to provide estimated basic APR calculation based on loan amount, rate, estimated closing costs and amortization.

EPPS-28405

New APIs Available to Create and Manage Correspondent Trade Notes

The Correspondent Trades APIs have been expanded to allow lenders to programatically add a note to a correspondent trade and manage existing notes.

Endpoint URL: /v1/trades/correspondent/{tradeId}/notes

The following new Correspondent Trades APIs are available with this release:

- Create a Trade Note. Adds a note to a correspondent trade.

- Manage Trade Notes. Updates or deletes an existing trade.

Usage Notes:

- To create, update, or delete notes via the APIs, the caller must have persona access to edit correspondent trades. Access is enabled in Encompass > Settings > Personas > Trades/Contacts/Dashboard/Reports tab > Trades area by selecting the Edit Correspondent Trades check box.

- Only one note can be created a time.

- When a note is created, updated, or deleted from an existing correspondent trade using these APIs, an event for “Trade Updated” is created in the correspondent trade history.

SEC-20529, SEC-20611, SEC-20868

New API to Retrieve User Roles

The Settings: Role API provides the ability to retrieve all the roles defined on the Encompass instance. The response includes details about the role, such as Role ID, Name, Abbreviation, assigned Personas and UserGroups, and whether the role has protected access to documents.

Endpoint URL: v1/settings/roles

EBSP-34589

Webhook Enhancements

Added Support for Exponential Back-Off for Retrying Failed Notification Attempts

The Encompass Platform now supports an exponential back-off retry policy that increases the resend interval for each webhook notification failure.

Retry Logic

If the Encompass Platform is unable to deliver a notification to the registered webhook callback or the callback fails to acknowledge the notification, the Encompass Platform will make other attempts to deliver the notification.

The following situations are considered a failed delivery attempt:

- HTTP status in the range 500-599.

- HTTP status outside the range 200-599.

- A request timeout (30 seconds). Note that if a request time-out occurs, the timing of the next retry attempt is based on the retry policy and number of failed attempts.

- Any connection error such as connection timeout, endpoint unreachable, bad SSL certificate, etc.

Default Retry Logic

By default, the Encompass Platform implements a linear back-off retry policy that will attempt delivery up to three times with a delay of 20 seconds between each retry. If the event is not delivered after three attempts, the notification is discarded.

Retry Logic with Exponential Back-Off

Exponential back-off can be applied to a webhook subscription to increase the resend interval for each failure. This policy allows for a longer retry period while not attempting to deliver the request constantly. When exponential back-off is applied to a subscription, any failed events will automatically retry for up to 8 hours with an exponential back-off interval. The table below shows the interval between retry attempts:

| RETRY ATTEMPT | SECONDS BETWEEN ATTEMPTS | TIME SINCE ORIGINAL WEBHOOK EVENT |

|---|---|---|

| 1 | 30 | 00:00:30 |

| 2 | 60 | 00:01:00 |

| 3 | 120 | 00:02:00 |

| 4 | 240 | 00:04:00 |

| 5 | 480 | 00:08:00 |

| 6 | 960 | 00:16:00 |

| 7 | 1920 | 00:32:00 |

| 8 | 3600 | 01:00:00 |

| 9 | 7200 | 02:00:00 |

| 10 | 10800 | 03:00:00 |

| 11 | 14400 | 04:00:00 |

| 12 | 18000 | 05:00:00 |

| 13 | 21600 | 06:00:00 |

| 14 | 25200 | 07:00:00 |

| 15 | 28800 | 08:00:00 |

Implement Exponential Back-Off for Webhook Subscriptions

The delivery policy for a webhook subscription is determined by the Subscription API deliveryPolicy parameter.

"deliveryPolicy":{"backoff":"linear | exponential"}

The deliveryPolicy parameter is optional. To implement exponential back-off for a webhook subscription, set the deliveryPolicy back-off parameter to “exponential”. If deliveryPolicy is not provided as input, the default retry logic, linear, is used.

curl --location --request POST 'https://<API_SERVER>/platform/v1/events/documentOrder' \

--header 'Content-Type: application/json' \

--header 'Authorization: Bearer <Token>' \

--data-raw '{

{ "endpoint": "<clientEndPoint>", "resource": "Loan", "events": ["create", "change", "update" ], "filters":{ "attributes":["/applications/0/borrower/firstName"] }, "deliveryPolicy":{"backoff":"exponential"} }

}'

PSS-33285

Webhook Support for Third-Party Service Orders

With this release, webhook subscriptions can be created to notify lenders when service orders are placed with third-party mortgage applications. When subscribed to the serviceOrder resource, the API will send a notification to the lender upon completion of each step in the service ordering workflow.

The following events are supported by the Webhook API for the serviceOrder resource:

| EVENT | DESCRIPTION | SUPPORT |

|---|---|---|

| Placed | When a service order is delivered to the third-party service provider. | API |

| Acknowledged | When a service order is acknowledged by the third-party service provider. | API |

| Fulfilled | When an order is completed and the response is successfully ingested into Encompass. | API |

| System Failure | When a system exception (API failure) occurred while attempting to prepare the order request. | API |

| Process Failure | When a process exception (e.g. business rule, authorization, access, and so on) occurred while attempting to prepare the order request. | API |

PSS-34451

Single Sign-On (SSO) Support for Developer Connect Integrations

This release of Developer Connect introduces support for SSO authentication with Developer Connect API integrations and SSO-enabled Encompass instances. This implementation provides a seamless and secure sign-in experience for clients when accessing SSO-enabled Encompass instances from Developer Connect API integrations.

Requirements

- SSO must be enabled on the Encompass instance

- Your company's identity provider (IdP) must be configured with ICE Mortgage Technology settings

- A Developer Connect API connection must be set up in Developer Connect

For additional details about these requirements and for step-by-step instructions about how to set up SSO for Developer Connect, see the Setting Up SSO for Encompass Products Guide.

Additional Resources

- Resource Center: ICE Mortgage Technology Identity Management Solutions page (guides, webinars, videos, and more)

- Setting Up SSO for Encompass

New Parameter Added to the Authorization Endpoint

To support the new SSO flow, new is_sso and instance_id query parameters have been added to the authorization endpoint. The is_sso parameter is required to indicate whether SSO authentication is to be used. A value of true indicates that SSO is enabled. The default value is false.

The instance_id query parameter directs the browser to the Developer Connect SSO login page. It is required when is_sso is true.

Updated authorization endpoint:

https://idp.elliemae.com/authorize?client_id=<client_id>&response_type=code&redirect_uri= <redirect_uri>&state=<state>&scope=lp&is_sso=false

Example for SSO:

https://idp.elliemae.com/authorize?client_id=<client_id>&response_type=code&redirect_uri[…]com/page/api-key&scope=lp&is_sso=true&instance_id=BE11211665

For more information about these parameters and to learn about using SSO with the supported authorization flows, see the Authentication page.

Fixed Issues

Incorrect Case for Custom Field Names in Update Loan API Caused Fields to Get Blanked Out

With the V1 and V3 Update Loan API, when the fieldName attribute for a custom field is passed without proper casing (for example, cust02fv instead of CUST02FV), it was leading the corresponding value of the custom field to get cleared out.

This issue is resolved with the 21.3 release of Encompass Developer Connect.

EBSP-30432

Cancelling a Rate Lock Extension Request via Rate Lock Cancellation API Still Counts Towards Total Number of Extensions

When cancelling an extension rate lock request through the API, the lock was still getting counted towards total number of extensions. This would be an issue when there is a limit defined on the number of extensions in Secondary Settings. This issue is resolved. With the fix, only confirmed extensions will get counted towards the total number of extensions.

EBSP-28118

June 21.2 Release Notes

Enhancements

User Token Impersonation Support for Developer Connect

With this release, Encompass Developer Connect supports a new user impersonation flow. User token impersonation enables privileged Encompass users to perform actions in Encompass under a different user account. For example, an Encompass user with a super administrator persona can run a scenario or update loan information in Encompass by impersonating the loan officer assigned to the loan. Previously, impersonation could only be achieved through the Encompass SDK.

Encompass Developer Connect supports the user impersonation flow by utilizing a custom “grant type” token exchange (urn:elli:params:oauth:grant-type:token-exchange). Developer Connect exchanges the access token of the currently logged-in user with a new access token that includes impersonation semantics, such as the user ID of the currently logged in user (actor_encompass_user) and the impersonated user. User names for both the impersonator and the impersonated user are logged in the audit trail table for loan operations.

Supported Impersonation Scenarios

Impersonation scenarios currently supported by Developer Connect are provided below. In all cases when a user impersonates another user, the access privileges of the impersonated user are applied to the API calls.

| This Encompass User/Persona… | Can Impersonate… |

|---|---|

| Super Administrator | All other Encompass users, including other SuperAdmin users. |

| Non-Super Administrator | Lenders with grant type resource owner password credentials can impersonate any other users at the same level or below them in the organization hierarchy. |

For more information about user token impersonation, see the Authentication section.

New and Updated V3 APIs

Loan Resource Lock APIs Now Available in V3

The Loan Resource Lock APIs provide the ability to return all resource locks or a specified resource lock on a loan, create a lock for the specified resource in Encompass, and unlock a specified resource in Encompass.

Endpoint URLs:

GET /encompass/v3/resourceLocks

GET /encompass/v3/resourceLocks/{lockId}

POST /encompass/v3/resourceLocks

DELETE /encompass/v3/resourceLocks/{lockId}

Field Reader API Now Available in V3

The Loan Field Reader API retrieves the values for the specified field IDs within a loan.

Endpoint URL:

POST /encompass/v3/loans/{loanId}/fieldReader

Support for DataVerify Flood Service

Ability to create service orders for DataVerify Flood and get status of the service order available with this release.

Endpoint URLs:

GET /encompass/v3/loans/{loanGuid}/serviceOrders

POST /encompass/v3/loans/{loanGuid}/serviceOrders

Prerequisites:

Prior to submitting your loans to DataVerify using Encompass Developer Connect APIs, the following need to be configured in Encompass Partner Connect:

- Create a new service setup in Encompass LO Connect Admin > Services Management.

- Download the CBC cURL API definition from Encompass LO Connect> Services Management> Manual Ordering> DataVerify Flood Services setting.

New and Updated V1 APIs

New Rate Lock API Added to Void a Rate Lock

A Lock Desk user can use the Void Rate Lock API to submit a request to void a pricing event (i.e., lock, relock, extension, denial, or cancellation) and return the lock to its previous state.

Note: This API is applicable only to pricing events in Correspondent Individual Best Effort loans that are not assigned to a Correspondent Trade.

Endpoint URL:

PUT /v1/loans/{loanId}/ratelockRequests/{requestId}/void?dataSyncOption=<>

Webhook Enhancements

Delete Event Now Supported for the Loan Resource

The Webhook API now supports the delete event for the Loan resource. Create a subscription to the delete event to receive notifications when a loan is permanently deleted from Encompass.

FieldChange Event Now Supported for the Loan Resource

The Webhook API now supports the fieldChange event for the Loan resource to provide users with finer-grained filtering than the Loan Change webhook. Create a subscription for the fieldChange event to receive notifications when a change occurs on a specified field, if the field is added to the Audit Trail Database.

Deprecated APIs

V1 EPPS APIs

Starting with the 21.2 release, which is currently scheduled for June 5, 2021, Encompass Developer Connect will no longer support the V1 EPPS APIs. In previous release notes and in the Deprecation Notice - EPPS V1 APIs, we announced that Encompass Developer Connect will stop supporting V1 EPPS APIs starting with this release, and we have recommended that developers who use the V1 EPPS APIs start using the V2 EPPS APIs. Please use the V2 EPPS APIs going forward to programmatically retrieve best-fit program and pricing information and to retrieve and select rates for Encompass loans.

Fixed Issues

Locked Fields in Data Templates Being Honored When Applied in v3 Create & Update Loan Apis

Earlier, field locks in data templates referenced as part of Loan Template Sets were being ignored, and Encompass calculations were being applied. With 21.2 June release, locked fields values will be applied. However, there is a known issue where a locked field, if set to null, is throwing a 500 Error. This is being fixed in 21.3 October release. This is working as expected in V1 Loan Management APIs.

EBSP-19272

Field Data Entry Business Rules With CurrentUser in Advanced Code Was Causing Loan Update to Fail

If CurrentUser method was being used in any Field Data Entry Business rule on an instance, and the loan met the criteria for the Business Rule execution, an "Advanced Code Definition execution failed" error message was preventing the loan from being updated through V1 and V3 Update Loan APIs. This has now been fixed in the 21.2 June release so that the advanced code in the business rule is properly evaluated, and appropriate response is returned.

EBSP-21348

Field Data Entry Business Rules Are Now Evaluated for All Applications in the Loan When the Rule Has a Value Check as Part of Advanced Code

The V1 and V3 Manage Loan APIs were evaluating the Field Data Entry Business Rule only for the primary borrower pair/ application when a value was specified as part of the business rule's Advanced Code. This is fixed with the 21.2 June release to validate the value against all Borrower pairs in the loan.

EBSP-27112

URLA 2020 Proposed Supplemental Property Insurance not Honoring the Itemization Fee Management Settings

Persona Access Rights and Itemization Fee management persona overwrite rules are now honored with the V3 Update Loan API for Lines 1007, 1008 and 1009.

EBSP-27996

April 21.1 Release Notes

Send Encompass Docs APIs

ICE Mortgage Technology is offering a new service to access V1 APIs in Developer Connect for generating, managing, and sending Encompass document packages.

The Send Encompass Docs service provides APIs to order initial disclosures, closing documents, and on-demand forms and send them to recipients (i.e., borrowers, co-borrower, and non-borrowing owners) via the Encompass Consumer Connect borrower portal. Recipients are notified by email when documents are available for them to view. The notification email includes a link to the borrower portal where the documents can be viewed, printed, and eSigned. When an order is sent, a Disclosure Tracking entry is created in Encompass. Lenders can retrieve documents that are completed by the recipient from the Encompass eFolder.

The following Send Encompass Docs APIs are available in this release:

API for Managing Plan Codes

-

Manage Plan Codes V1 API

Retrieves a list of company plan codes and applies program data from a selected plan code to a loan file. Any plan code conflicts are provided in the response.APIs:

GET /encompassdocs/v1/planclodes

POST /encompassdocs/v1/planCodes/{planCodeId}/evaluator

APIs for Managing Document Packages

-

Opening Packages (Initial Disclosure) V1 API

Initial Disclosure Packages are also known as Opening documents in Encompass Developer Connect. The /opening endpoint provides methods to audit a loan, order disclosures, generate and send the opening (three-day) package to borrowers.APIs:

POST /encompassdocs/v1/planclodes/{planCodeID}/evaluator

POST /encompassdocs/v1/encompassdocs/v1/documentAudits/opening

POST /encompassdocs/v1/encompassdocs/v1/documentOrders/opening -

Closing Packages V1 API

The /closing endpoint is provided with methods to audit a loan, order docs, generate, and send Closing documents to the Settlement Agent. Once the package is sent, a notification will be sent to the recipient with the pre-signed URL for accessing the forms to be printed and signed at closing. A compliance audit (by Mavent) is included with Closing document orders.APIs:

POST /encompassdocs/v1/planclodes/{planCodeID}/evaluator

POST /encompassdocs/v1/encompassdocs/v1/documentAudits/closing

POST /encompassdocs/v1/encompassdocs/v1/documentOrders/closing -

On-Demand Document Orders with Additional Forms V1 API

One or more additional forms can be added to an existing package using the /forms endpoint. When Loan Estimates or Closing Disclosures are added to a document package, the package will be tracked with the Disclosure Tracking Tool in Encompass.Endpoint URL:

POST /encompassdocs/v1/documentOrders/forms

API for Retrieving Loan Recipients and Authentication Codes for Doc Orders

-

Retrieve List of Loan Recipients V3 API

A new V3 Loan: Recipients API is available for retrieving all recipients associated with a loan. Recipients can include the borrower, co-borrowers, and non-borrowing owners on a loan. This API also returns authentication codes when applicable.Endpoint URL:

GET /encompass/v3/loan/{loanId}/recipients

API for Retrieving Disclosure Tracking Settings to Select Forms for On-Demand Doc Orders

-

Retrieve Disclosure Tracking Settings V3 API

A new V3 Settings: Disclosure Tracking API is available for retrieving the Disclosure Tracking settings defined in Encompass > Settings > Loan Setup > Disclosure Tracking Settings. This can be used to choose the list of forms to be sent out as part of On Demand Disclosure packages.Endpoint URL:

GET /v3/settings/loan/disclosureTracking

Additional Resources

To get started with the Send Encompass Docs APIs, see the Ordering Document Packages blog post.

Correspondent Trades API

New API Available to Unassign Loans from a Correspondent Trade

The Delete method is now available for the Correspondent Trade API. Use this API to systematically unassign loans from a Correspondent Trade.

Endpoint URL:

DELETE /secondary/v1/trades/correspondent/{tradeId}/loans

Update Correspondent Trade API Now Supports action=updateStatus

The Update Correspondent Trade API now supports updateStatus as a value for action query parameter. Use updateStatus to edit a single Correspondent Trade or to change a commitment status to Committed, Delivered, or Settled.

Endpoint URL:

PATCH /secondary/v1/trades/correspondent/{tradeId}?action=updateStatus

Enhancements

Changes Made to Disclosure Tracking Logs & Time Zones

As described in the Encompass April Release Notes, a change has been made to the timeline calculations used by the Disclosure Tracking tool to help ensure dates and times are consistent across all the Disclosure Tracking log entries in a loan.

As part of this change, the Disclosure Tracking 2015 Log object in the V3 Loan Schema has been updated. All Date-related attributes (i.e. applicationDate, disclosureCreatedDate, and so on) in the Disclosure Tracking 2015 Log object will be stored in Date-only format (YYYY-MM-DD), without the time or time zone indicator. The time zone for these Date-related attributes will be determined by the value of Encompass field LE1.X9 (Closing Costs Estimate Expiration Time Zone), which is set depending on Encompass settings and calculations.

For details about this change and to learn how it impacts existing and new loans, please refer to the Knowledge Article: Disclosure Tracking Logs & Time Zones (KA-39455).

Assign Loan Officer during Loan Creation using V3 API

With V3 Create Loan API, you can now assign a loan officer at the time of creating the loan. A new query parameter loID has been added so that you can pass the userId of the loan officer.

Endpoint URL:

POST /encompass/v3/loans?loID=< >

Clear BuySide and SellSide Data in Rate Lock Requests

A new query parameter clearEntities has been introduced to the Update Rate Lock request API. In order to clear out an entity, simply pass “buySide” and/ or “sellSide” as the parameter value instead of having to pass every attribute as an empty string in the request payload.

Endpoint URL:

PATCH /encompass/v1/loans/{loanId}/ratelockRequests/{requestId}?clearEntities=<buySide,sellSide>

Services API Enhancements

A new request type, RequestReportFiles, is being added in this release. Use this request type to retrieve raw XML files for service reports, (such as credit services, Fannie Mae DU and EarlyCheck, and Freddie Mac LPA) after the service order has been completed.

Endpoint URL:

GET /services/v1/partners/{{Service_Partner_ID}}/transactions

NOTE: This requestType is supported for admin and super admin users only.

Fixed Issues

Performance Optimization of Loan Update API Calls

For Calculated Custom Fields configured with Advanced Code including fields referencing the applicationIndex, only custom fields related to the modified applicationIndex will be run, instead of running calculations for all borrower pairs. For example, if CUST01FV has a calculation based on 4000#1 and CUST02FV has a calculation based on 4000#2, and only 4000#2 was updated, only CUST02FV custom field will be recalculated. This will improve the performance of Loan Update API calls, especially when the instance is configured with many custom fields.

EBSP-27952

Milestone Date Calculations

As part of the loan creation process, if you complete a milestone that is after the “File Started” milestone, prior milestone dates were being calculated based on the number of business days configured in the settings. This was resulting in a milestone completion date prior to the loan creation date. With this release, all the prior milestones will be set to the same date as the completed milestone. For example, if the Qualification milestone is marked as completed as part of the loan creation process, and Qualification is configured to take 3 business days, File Started & Qualification milestones will have the same date of completion. This issue has been addressed in V1 and V3 loan creation flows.

EBSP-25537

Populating Loan Originator Fields Based on Instance Policy Settings for URLA 2020 Loans

For an URLA 2020 Loan, v1 and v3 APIs to Create a Loan with an assigned loan officer should populate URLAX.170, URLAX.171, URLAX.172, URLAX.173 and 1612 based on the settings configured in Encompass Admin Settings. If the Interviewer Name is configured to populate LO details, the user's details passed in loId attribute needs to be used to populate the mentioned fields instead of populating the loan starter’s details. This works as expected for 2009 loans, and this defect has been fixed for URLA 2020 Loans.

EBSP-28957

Loan APIs to Honor Persona Access to Loans Business Rules Based on Milestones

An issue was identified with the Loan CRUD APIs where all Persona Access to Loans Business Rules were being applied irrespective of the milestone stage that the loan is in. This issue has been resolved. Business Rules that are configured to be applied based on a given milestone are now applied as expected.

EBSP-28027

Field Data Entry Business Rules with [value] in Advanced Code Run on Saved and New Versions of Loan

There was a parity gap identified between Encompass Smart Client and APIs where the V1 Update Loan API was running Field Data Entry Business rules twice - once only on the request payload and a second time on the new version of the loan file. With this fix, APIs will continue executing the Field Data Entry rules twice – once on the combination of request payload and saved version of the loan, and a second time on the new version of the loan.

EBSP-27074

February 21.1 Release

New and Updated APIs

New Workflow Task Pipeline API

The new Workflow Task Pipeline API is available with this release of Encompass Developer Connect.

The Get Task Pipeline API retrieves a workflow task pipeline. Apply filters to narrow and sort workflow tasks returned in the response.

Endpoint URL: workflow/v1/taskPipeline

Enhancement to Rate Lock API

The Submit Rate Lock API has been enhanced to support the Revise action for a Secondary user. Use action=revise to update existing active and expired locks.

Endpoint URL: /loans/loanId/lockRequests?action=revise&requestId=

Webhook API Update

For customers with Encompass 20.2 instances or higher, the meta.resourceRef URL now points to V3. With this change, the meta.resourceRef URL is returned as /v3/loans/{loanId} instead of /v1/loans/{loanId}.

New Blog Post

A new blog post will be available on the Developer Connect portal about Calculations & Business Rule Execution. It will describe the sequence of events that occur in an API call for evaluating rules and calculations.

Fixed Issues

The Custom Field Format for MonthDay (mm/dd) is Enforced

With this release, the Custom Field - MonthDay format (mm/dd) in the Loan API is enforced. If an incorrect date or date format is passed, the API will return a status code of 400.

EBSP-22646

January 20.2 Service Pack

Ellie Mae will be replacing the EPPS V1 APIs with our new EPPS V2 APIs. Our EPPS V1 APIs will continue to be supported until Q2 of 2021. We recommend that you start transitioning to the EPPS V2 APIs. For more information about the new EPPS V2 APIs and for migration information, see the Deprecation Notice for EPPS V1.

New V1 Prospect Engagement APIS

The 20.2 January release of Encompass Developer Connect introduces the new Prospect Engagement Invite and Remind APIs. These APIs extend the capabilities of the upcoming Prospect Engagement feature in LO Connect and Velocify to other third-party systems.

About the Prospect Engagement Feature in Velocify Lead Manager and LO Connect

The ICE Mortgage Technology Lending Platform is introducing a new Prospect Engagement feature this year that tightens the integration between Velocify Lead Manager, LO Connect, and Consumer Connect while providing an enhanced experience for prospects, such as leads, opportunities, or potential borrowers. This feature enables LO Connect and Velocify users to Invite these prospects to start a loan application and Remind them to complete an existing loan application in Encompass Consumer Connect. The invitation and reminder notifications sent to prospects include a direct link to their new or existing loan application. The loan applications are pre-populated with data captured by LO Connect or Velocify systems.

The Prospect Engagement feature will be available in Velocify Lead Manager and LO Connect in Q2 of this year.

Use these APIs to generate a link for the consumer that will start a new loan application or resume an existing incomplete loan application. The loan application will contain pre-populated data captured by the client system.

The Prospect Engagement APIs include the following endpoints:

-

Invite: Use this API to generate a link to a new Encompass Consumer Connect loan application. The link can be inserted into a customer communication to invite a prospect to start a loan application.

Endpoint URL: consumer/v1/invitations -

Remind: Use this API to generate a link to an existing incomplete loan application in Encompass Consumer Connect. The link can be inserted into a customer communication to remind a prospect to complete and submit their loan application.

Endpoint URL: consumer/v1/reminders

Updates to V1 Loan Transformer API

The Loan Transformer API now supports the export of loans to ILAD format.

Endpoint URL: GET /services/v1/transformer?loanid=<>&format=ILAD

New V3 APIs for Verifications Support and New URLA

This release introduces new APIs for URLA Alternate Names and Verifications.

-

URLA Alternate Names: Use this API to manage the applicant’s Alternate Names

Endpoint URL: /v3/loans/{loanId}/applications/{applicationId}/{applicantType}/urlaAlternateNames -

Verificationsverification-of-liabilities: Use these APIs to manage various types of verification entities within each application in the loan

-

OtherLiabilities

Endpoint URL: /v3/loans/{loanId}/applications/{applicationId}/otherLiabilities -

OtherIncome

Endpoint URL: /v3/loans/{loanId}/applications/{applicationId}/otherIncomeSources -

OtherAssets

Endpoint URL: /v3/loans/{loanId}/applications/{applicationId}/otherAssets -

AdditionalLoans

Endpoint URL: /v3/loans/{loanId}/applications/{applicationId}/additionalLoans -

GiftsAndGrants

Endpoint URL: /v3/loans/{loanId}/applications/{applicationId}/giftsGrants

-

Fixed Issues

Resolved Issue with Persona Access to Loans Business Rules with Custom Edit Access

An issue existed with Persona Access to Loans business rules that have Custom Edit access to the Lock Request and Profit Management tools. When such business rules were applied to a loan, users with that persona were not allowed to perform create/update operations with the Lock Request or Profit Management tools even though they had Edit Access to these sections.

This issue has been resolved.

EBSP-25775

Resolved Issue that Prevented Super Administrators from Accessing Hidden Fields

An issue existed with field access rules that grant access only to users with the Administrator persona. With this issue, access was restricted to all other personas as expected, however, super administrators were also restricted when using the GetLoan call.

This issue has been resolved and now users with a super administrator persona can access fields where an Administrator persona is required.

EBSP-25726

December 20.2 Service Pack

This API is similar to the loan update-related functions of the Assign Loans API but does not assign new loans to the correspondent trade. The Extend Loans for Correspondent Trade API processes loans that are assigned to the trade. The loans must have an Assigned status. Loans that have not been assigned cannot be extended using the API.

Endpoint URL: /secondary/v1/trades/correspondent/TradeId/loans/extend

November 20.2 Major Release

New Enhanced Conditions V3 APIs

Encompass Developer Connect provides the following sets of V3 APIs to create and manage Enhanced Conditions: Manage Enhanced Conditions, Enhanced Conditions Settings, and the Automated Conditions Evaluator API.

Manage Enhanced Conditions

The APIs for Managing Enhanced Conditions allow Encompass Web and Encompass TPO Connect to access Enhanced Conditions metadata for managing loan and document conditions in a loan file. These APIs provide methods to retrieve, add, remove, update, and delete enhanced conditions in a condition set, to manage condition comments, and to assign or unassign condition documents.

The following APIs are available to manage enhanced conditions in the loan:

Endpoint URL: /encompass/v3/settings/loan/loanId/conditions

- Get All Enhanced Conditions. Retrieve a list of enhanced conditions for a loan.

- Get an Enhanced Condition. Retrieve details about a specified enhanced condition.

- Manage Enhanced Conditions. Add, update, remove, or duplicate an enhanced condition in a loan.

Endpoint URL: /encompass/v3/settings/loan/loanId/conditions/conditionId/comments

- Get Comments. Retrieve comments for enhanced conditions.

- Manage Comments. Add, update, and remove comments for enhanced conditions.

Endpoint URL: /encompass/v3/settings/loan/loanId/conditions/conditionId/documents

- Get Documents. Retrieve documents of an enhanced condition.

- Manage Documents. Add, update, remove documents for an enhanced condition.

Endpoint URL: /encompass/v3/settings/loan/loanId/conditions/conditionId/tracking

- Get Status Tracking Entries. Retrieve the status of tracking entries for an enhanced condition.

Enhanced Conditions Settings

The APIs for Enhanced Conditions Settings define condition types, statuses, sources, recipients and Prior To values, as well as define which actions can be taken on a given condition template based on multiple factors, including the user’s role.

The following APIs are available for managing Enhanced Conditions Settings in Encompass:

Endpoint URL: /encompass/v3/settings/loan/conditions/types

- Get All Enhanced Condition Types. Retrieve a list of all condition types.

- Get an Enhanced Condition Type. Retrieve a specified condition type.

- Manage Enhanced Condition Types. Adds, updates, or removes a condition type.

Endpoint URL: /encompass/v3/settings/loan/conditions/set

- Get All Enhanced Condition Sets. Retrieve a list of all condition sets.

- Get an Enhanced Condition Set. Retrieve a specified condition set.

Endpoint URL: /encompass/v3/settings/loan/conditions/templates

- Get All Enhanced Condition Templates. Retrieve a list of all condition templates.

- Get an Enhanced Condition Templates. Retrieve a list of all condition templates.

- Manage Enhanced Condition Templates. Add or update an enhanced condition template.

Automated Conditions Evaluator API

The Automated Conditions Evaluator API evaluates the Automated Enhanced Conditions Business Rules set up in Encompass Settings and returns the list of condition templates that can be applied to the loan, given the state of the loan.

Evaluate Automated Conditions

Endpoint URL: /encompass/v3/calculators/automatedConditions

- Evaluate Automated Conditions. Retrieve a list of condition templates that can be applied to the loan, based on the given the state of the loan.

Updated V3 APIs

Enhancement to Update Loan API

V3 Stateless Update Loan API has been updated enabling you to apply a loan program template to an existing loan.

New Settings API - Retrieve List of Loan Program Templates

New API to get the list of loan program templates, along with the full path, which can then be applied to an existing loan.

New and Updated V1 APIS

The following new and updated V1 APIs are available with the Encompass Developer Connect 20.2 November release.

Webhook Event History API

-

New Query Parameters Added to Webhook Get All Events API

Two new query parameters, subscriptionId and resourceId, have been added to the Webhook Get All Events API.

A subscription ID is the unique ID assigned to a subscription when it is created. You can now use the subscriptionId query parameter to return the event history for a specified subscription.

A resource ID is the unique ID of a resource (i.e. Loan); it is also known as the loan GUID. The resource ID can be associated with an event subscription. You can use the resourceId query parameter to return the event history of a specified loan. -

Query Parameters Now Case-Insensitive

The Webhook Event History query parameters are no longer case-sensitive. -

DeliveryAttempted Status for Events

To identify an undelivered notification, check for DeliveryAttempted status for events.

A DeliveryAttempted status is logged only when there is a failure from the subscription webhook endpoint. Check DeliveryAttempted statusDetails for an error response code and error response details from the subscription webhook endpoint.

Rate Lock Updates - Support for Applying the Loan Program Through Submit Rate Lock API

APIs have been updated with this release to support the application of a loan program through the existing Submit Rate lock API by passing the full path of the template with a new attribute.

If both Template and Payload are sent, and payload values are same as template, the values are retained. If payload values are different from the template values, payload values will replace the template values.

New EPPS V2 APIs

Deprecation Notice - EPPS V1 APIs

Ellie Mae will be deprecating EPPS V1 APIs to make way for our new EPPS V2 APIs. Our EPPS V1 APIs will continue to be supported until Q2 of 2021. We are making the EPPS V2 APIs available with this release to allow developers to get familiar with the APIs while maintaining the existing behavior as the APIs are backward compatible. For more information see the Deprecation Notice for EPPS V1 APIs.

The EPPS APIs are moving to V2. The V1 and V2 APIs are largely the same; however, we have made some changes in the V2 contracts. The most significant change was made to the Get Programs and Rates (/loanQualifier endpoint) and Get Rates (/eligibility endpoint) schemas. The standardProduct contract in these schemas has changed from a hard-coded list of Standard Products to an Array of Product IDs. You can use the Lookups API for Standard Products to get all possible values.

Example array:

“standardProducts": [1,5,2,3,4]

Lookups APIs

The Encompass Developer Connect 20.2 release introduces new EPPS Lookups APIs. Use the Lookups APIs to search for certain types of loan information across the Product and Pricing system.

Agency Approvals. Returns all Agency Approvals related to the user. The response contains key-value pairs.

Bankruptcy. Returns all records from the Bankruptcy table for the given user. The response contains key-value pairs.

Counties. Returns a list of counties available for a given state. The response contains key-value pairs.

Delivery Types. Returns Delivery Types available to the user. The response contains key-value pairs.

Encompass Elements. Returns the Encompass Elements set for the user. The response contains key-value pairs.

Foreclosure. Returns all records from the Foreclosure table for the given user. The response contains key-value pairs.

Investors. Returns all valid Investors for the user. The response contains key-value pairs.

Lien Position. Returns all the Lien Position options associated with the user. A list of key-value pairs is returned in the response.

Loan Terms. Returns all Product Options associated with the user. The response contains key-value pairs.

Loan Usage. Returns all the Loan Usage options associated with the user. A list of key-value pairs is returned in the response.

Lock Days. Returns all Lock Days related to the user. The response contains a list of lock days and VirtualLock.

Prepay Penalty Terms. Returns Prepay Penalty Terms. The response contains key-value pairs.

Product Options. Returns all Product Options associated with the user. A list of key-value pairs is returned in the response.

Property Type. Returns all Product Types associated with the user. A list of key-value pairs is returned in the response.

Property Use. Returns Property Use in the form of a list of key-value pairs for the given user.

Special Products. Returns all Special Products associated with the user. A list of key-value pairs is returned in the response.

Standard Products. Returns all Standard Products available to the user. A list of key-value pairs is returned in the response.

States. Returns all states available for a given user. Response includes State ID, State Name, and Abbreviation.

September 20.1 Service Pack

New and Enhanced APIs

V1: New Webhook Event History APIs

The Webhook Event History APIs are being introduced in V1 to provide lender developers with the ability to retrieve webhook events that were triggered on the Lender Platform. Using these APIs, lender developers can query webhook events according to status, time range, event type, event ID, and resource type. These APIs were created to help lender developers reconcile any missed events.

Endpoint URL: /webhook/v1/events/

- Get All Events returns all webhook events that occurred on the Lender Platform. Results can be refined using query parameters.

- Get an Event returns the specified webhook event.

For additional information about the Webhook Event History APIs, check out the 20.1 September blog post, Webhook Best Practices: Event Reconciliation and More

V1: New MISMO 3.4 Export API

New Transformer API is available in this release. It can be used to export URLA 2020 loans in MISMO 3.4 format.

Endpoint URL: /services/v1/transformer?loanId={}&format={}

Enhanced Services

Support for Factual Data by CBC Credit Partner

With this release, the Developer Connect Services API will support ordering and retrieving consumer credit reports from Factual Data by CBC.

August 20.1 Service Pack

Encompass Developer Connect Support for New URLA

A redesigned version of the Uniform Residential Loan Application (URLA), also known as the Fannie Mae form 1003 or the Freddie Mac form 65, is replacing the 2009 version of the URLA effective March 1, 2021. In addition, a new corresponding MISMO v3.4 dataset a.k.a. the Uniform Loan Application Dataset (ULAD) is also being introduced in conjunction with this newly designed URLA. The URLA is required for lenders to originate loans eligible for sale on the secondary market and to satisfy the safe harbor requirements of the Equal Credit Opportunity Act (ECOA).

The redesigned 2020 URLA makes it easier for lenders to collect information required by the Home Mortgage Disclosure Act (HMDA) and to incorporate additional application information identified under the URLA/ULAD initiative. The output form has a similar look and feel to the Loan Estimate and Closing Disclosure forms implemented in 2015 and was designed to provide a better experience for borrowers by providing clear instructions in language that is easy to understand.

Our goal is to ensure that our customers and our software are ready for the upcoming changes. While we cannot advise you on how to manage compliance in your own organization, we can help ensure that you have the tools and resources you need to be ready when the revised regulation takes effect.

Starting with the 20.1 August 2020 Service Pack release, URLA 2020 loan submissions are being supported on Encompass Developer Connect. Loan submissions to GSE-specific AUS production environments using the new URLA 2020 output forms are currently scheduled for January 1, 2021, with a mandatory usage date of March 1, 2021.

Impacted (Existing) APIs

Loan Schema APIs

The new URLA fields can be viewed as part of these APIs to discover the location of the collections and fields within the loan object:

- V1 Get Loan Schema

- V1 Get Field Schema API

- V3 Loan Schema API

- V3 Standard Fields API

- V1 Path Generator

- V1 Contract Generator

Loan Pipeline APIs

The new URLA fields can be viewed and queried as part of these APIs:

Loan Management APIs

The V1 Loan CRUD APIs will support all the new URLA fields.

New APIs: V3

As part of this release, we are also releasing the new version of APIs – the V3 APIs. These new APIs will also have URLA Support.

V3 Loan CRUD

MISMO 3.4 Import

New MISMO APIs are available in this release. They can be used to import a new loan or an existing loan in MISMO 3.4 format.

- V3 Converter API converts a MISMO 3.4 file to create a loan object

- V3 Importer API imports a MISMO 3.4 file to update an existing loan

Managing URLA Version

Use this Settings API to retrieve the Instance Level URLA configuration:

GET /v3/settings/policies/urla

Use the Update URLA Version endpoint to switch the URLA version of the loan:

PATCH /v3/loans/{loanId}/urlaVersion

Refer to the Blog Post we have published for URLA Support through Developer Connect.

Secondary Settings API

New Secondary Settings APIs

New Secondary Settings APIshave been added to Encompass Developer Connect V3. Use these APIs to retrieve all investor templates available in Encompass and to retrieve a single investor template.

- Get Investor Templates retrieves a list of investor templates available for a client performing a price or lock action.

- Get an Investor Template retrieves details for a specified investor template. Template values based on the selected investor can then be applied when locking a loan.

Documentation Updates

Enhancements Made to the V3 Attachments API Documentation

Enhancements have been made to the V3 Attachments API reference documentation. Check out the latest documentation here on the Encompass Developer Connect portal.

New Topic About V3 Cloud Storage Added to Get Started Section of V1

A new topic has been added to the Developer Connect portal to provide additional information about V3 APIs and Loan Attachments. This new topic About V3 Cloud Storage for Loan Attachments is available in the V1 area of the portal, listed below the Release Notes.

Enhancements Made to the How to Become a Supported Encompass Partner Topic

Enhancements have been made to Encompass online help topic, How to Become a Supported Encompass Partner. In addition, the information provided in the help topic is now available in the Ellie Mae Resource Center.

Fixed Issues

Resolved Issue with Get External Organizations API

Some clients experienced an issue when using the V3 Get External Organizations API (/v3/externalOrganizations/tpos) to retrieve TPO company information. With this issue, the API call would fail intermittently if the load was under high concurrency. This issue has been resolved.

SRE-11648

June 20.1 Critical Patch

Enforce Persona Access to Loans and Persona Access to Fields Rules on Loan Data Access APIs

Partners using the restricted persona for API access through Encompass Developer Connect will now have restricted access to the loan file based on Encompass Persona Access to Loans and Persona Access to Fields rules. This change is being applied to the V1 Encompass Field Reader only. If the API user’s persona does not have entitlements to a loan file based on the configured rule, the loan will not be returned through any of these APIs. Similarly, if the partner’s configured persona does not have access to view an individual field based on the configured rules, they will not see the field data returned through these APIs.

Please note, this same update to Loan Data Access APIs is planned to be applied for V1 Get Loan in a separate release on Saturday, June 13.

EBSP-20540

May 20.1 Service Pack

Loan Opportunities APIs

Ellie Mae is offering a new service to access V1 APIs in Developer Connect for creating and managing Opportunities-Loan Scenario tool. This service provides the APIs to create and update loan opportunities, compare up to 10 loan scenarios, convert a loan scenario into a loan, run EBS calculation on the loan scenario object, and ability to email scenario(s), and Eligibility letter to the borrower using the Loan Opportunity notification service.

The following Loan Opportunities APIs are available in this release:

Loan Opportunity Management

Endpoint URL: /encompass/v1/loanOpportunities

- Get All Loan Opportunities retrieves opportunities with search criteria in a paged list.

- Get an Opportunity retrieves information about a specified opportunity.

- Create Opportunity creates a new opportunity.

- Convert to Opportunity Contract converts a loan contract to a loan opportunity contract.

- Update an Opportunity updates an existing opportunity.

- Delete an Opportunity removes a specified opportunity.

Document Management for an Opportunity

Endpoint URL: /v1/loanOpportunities/{OpportunityId}/documents

- Create a Document creates a new document for a specified opportunity.

- Get a Document retrieves an existing document from an opportunity.

- Replace a Document updates an existing document for an opportunity.

Notification Request

Endpoint URL: /v1/loanOpportunities/{OpportunityId}/notifications

- Send Notification Request triggers a notification request to be sent to the recipient.

Scenario Management

Endpoint URL: /v1/loanOpportunities/{OpportunityId}/scenarios

- Get All Scenarios retrieves all scenarios for a specified opportunity.

- Get a Scenario retrieves an existing scenario from an opportunity.

- Create Scenario creates a new scenario for a specified opportunity.

- Update a Scenario updates an existing scenario for an opportunity.

- Delete a Scenario removes a specified scenario from an opportunity.

- Convert Scenario to Loan converts the information in the opportunity and scenario to a loan contract.

Loan Opportunity Selector

Endpoint URL: /v1/loanOpportunitySelector

- Get Loan Opportunities retrieves specific details of opportunities with search criteria in a paged list.

Loan Opportunity Settings APIs

The Loan Opportunity Settings API provides the ability to configure settings related to the Scenario Comparison Tools feature.

Affordability Qualification Settings

Affordability Qualification APIs configure the housing and debt ratio limitations based on the product type. When an opportunity is created and the income and liabilities for the borrowers have been entered, the scenario reflects if the current data is within the defined limitations set.

Endpoint URL: /v1/settings/affordabilityQualification

- Get Affordability Qualification Settings retrieves Affordability Qualification settings.

- Create Affordability Qualification creates settings to determine affordability.

- Update an Affordability Qualification updates an existing Affordability Qualification setting.

- Delete an Affordability Qualification removes a specified Affordability Qualification setting.

Email Template Management

The Email Templates APIs configure the email template for when the user emails the generated Scenarios or Eligibility letter to a borrower.

Endpoint URL: /v1/settings/emailTemplates

- Get Email Templates retrieves email templates filtered by various criteria.

- Create Email Template creates a new email template.

- Get an Email Template retrieves a specified email template.

- Update an Email Template updates an existing email template.

- Delete an Email Template removes a specified email template.

Feature Management

The Feature Management APIs manage the feature and feature settings for Loan Opportunities.

Endpoint URL: /v1/settings/featureManagement

- Get Feature Management Settings retrieves Feature Management settings for the specified category and feature.

- Create New Feature creates a new Feature entry for a specified category.

- Update a Feature Management Setting updates an existing Feature Management Setting.

- Update a Feature updates an existing Feature.

- Delete a Feature Management Setting removes a Feature Management Setting.

Letter Template Management

The Letter Template APIs manage the template that is used to generate Eligibility Letters within an opportunity.

Endpoint URL: /v1/settings/letterTemplates

- Get Letter Templates retrieves Letter Templates filtered by various criteria.

- Create Letter Template creates a new Letter Template.

- Get a Letter Template Details retrieves a specified Letter Template.

- Update a Letter Template updates an existing Letter Template.

- Delete a Letter Template removes a specified Letter Template.

Fixed Issue

Loan Schema

Resolved: Incorrect contractPath for DISCLOSURE.X1188 in Standard Fields API

A discrepancy was observed between the contract path for DISCLOSURE.X1188 in Standard Fields API and Loan API response. This discrepancy prevented the loan data for DISCLOSURE.X1188 from parsing successfully.

Endpoint URL: .../encompass/v3/schemas/loan/standardFields?ids=DISCLOSURE.X1188

This issue is resolved with the 20.1 May service pack.CBIZ-31210

April 20.1 Major Release

New V3 APIS

The Encompass Developer Connect 20.1 April release introduces the following new V3 APIs:

External Organizations and Users APIs

Use the External Organizations and Users APIs to create and manage lenders, brokers, and third party originators (TPO) with whom your company does business.

External Organizations

- Get External Organizations API retrieves a list of external organizations. Query parameters can be used to filter results.

- Get an External Organization API returns information about a specified TPO company or branch.

External Users APIs

- Get External Users API retrieves details about all external TPO users. Use query parameters to filter results.

- Get an External User API returns information about a specified TPO user.

- Get Effective Rights of External User API returns information about the effective rights of a specified TPO user.

Loan Pipeline APIs

The Loan Pipeline APIs provides methods to search for loans on the Pipeline. The View API returns all loans in the Pipeline to which the user has access. The results can be filtered and sorted to return more precise results.

- Query Pipeline (with Pagination) API retrieves pages of loan IDs (GUIDs) and specified fields from loans on the Pipeline.

- Get Canonical Names API retrieves the loan pipeline field definitions.

Schema APIs

A loan schema specifies the entities and data elements in a loan resource. Use the Schema APIs to retrieve all schema information, a certain set specified by field ID, and virtual field definitions for a loan.

- Get Loan Schema API retrieves the schema for a loan.

- Get List of Virtual Fields APIsretrieves virtual field definitions for a loan.

Loan Folder APIs

Loan folders allow lenders to organize loans into groups. Loan folders can be created to group loans by categories such as month of origination, loan status, or loan type. The Loan Folder APIs provide methods for creating and managing loan folders.

- Get Loan Folders API returns a complete list of loan folders; including the Trash folder to which the user has access rights.

- Get a Loan Folder API returns information about a specified loan folder.

New and Updated V1 APIS

The following new and updated V1 APIs are available with the Encompass Developer Connect 20.1 April release:

Correspondent Trades API

Ellie Mae is now offering a new service to access V1 APIs in Developer Connect for managing your Correspondent Trade needs. Developers will be able to make new API calls for creating and updating correspondent trades as well as making calls for loan assignments. In addition, there are APIs for calling the Trade Details and Trade Pipeline. There are also APIs for retrieving the Notes, History and loan assignment metrics of a correspondent trade. These new APIs can be used in the 20.1 version along with the latest features being introduced in the release for Authorized Trader, supporting new delivery types, updating commitment statues, and new pair-off functionality. Making these APIs available on Developer Connect will remove restrictions of solely working with .net applications.

Trade Pipeline

The Trade Pipeline APIs provides methods to search the Pipeline for correspondent trades. The View API returns all loans in the Pipeline to which the user has access. The results can be filtered and sorted to return more precise results.

- Get Trade Pipeline of Correspondent Trade API retrieves Pipeline for a correspondent trade.

- Get Field Definitions API retrieves specific field definitions to populate the Trade Pipeline.

Trade Management

- Create a Correspondent Trade API creates a correspondent trade.

- Get Correspondent Trade API retrieves information about a specified correspondent trade.

- Update Correspondent Trade API updates the commitment status or edit a single correspondent trade.

- Get Event History API retrieves the event history of a correspondent trade.

- Assign Loans to Correspondent Trade API assigns and updates loans to a correspondent trade.

- Get Correspondent Trade Notes API retrieves the notes from a correspondent trade.

- Get Correspondent Trade Statistics API retrieves the loan assignment metrics for a correspondent trade.

Webhooks API

Enhanced Support for Webhook Notifications for clients on 20.1

Webhooks provide a way to send notifications when certain events occur on a loan resource. For example, your client application can subscribe to receive notifications when a new loan is created or when contact information for a business contact is updated. Previously, the Webhook API supported notifications for only loan and transaction resources. With this release, Webhook API support has been expanded to other loan events such as Documents, Enhanced Conditions, Milestones, and External Orgs. Subscribing to any of these events will generate a Webhook notification when certain subevents occur.

The following table displays the newly supported loan event and the subevents that generate a notification:

| Resource | Event | Subevent |

|---|---|---|

| Loan | Documents (via API only) | Create (createDocuments) Update (updateDocuments) Assign Attachment (assignAttachmentsToDocument) |

| Milestone (via API only) | Update (updateMilestones) Complete (finishMilestones) | |

| ExternalOrganizations | Create (via SmartClient only) | |

| Update (via SmartClient only) | ||

| ExternalUser | Create (via SmartClient only) | |

| Update (via SmartClient only) |

Rate Lock API: Support for Additional Rate Lock Request Field Management

The lock request form includes the capability to mirror one or more loan-level standard or custom fields in addition to the base data set included in the lock request form itself. This data can be identified in Encompass > Settings. When a new lock request form is created, the loan data is mirrored to both the lock request fields and the additional lock request fields. This data can then be modified through Encompass Smart Client if there are variations added during the course of pricing scenarios for the loan file. When the lock is confirmed, this data is synchronized back to the corresponding loan-level fields and logged in the associated lock request snapshot. Previously, these fields could not be modified through Encompass APIs. With this release, custom fields that are set up under Settings > Secondary Setup > Lock Request Additional Fields are now supported as part of the followings V1 APIs:

- Create Loan

- Update Loan

- Get Loan

- Create Rate Lock Request

- Get Snapshot of Rate Lock Request

January 19.4 Service Pack

Usage Note

The Webhook eventTime attribute for Transaction resources now follows the ISO 8601 specification in UTC/Zulu time.

November 19.4 Major Release

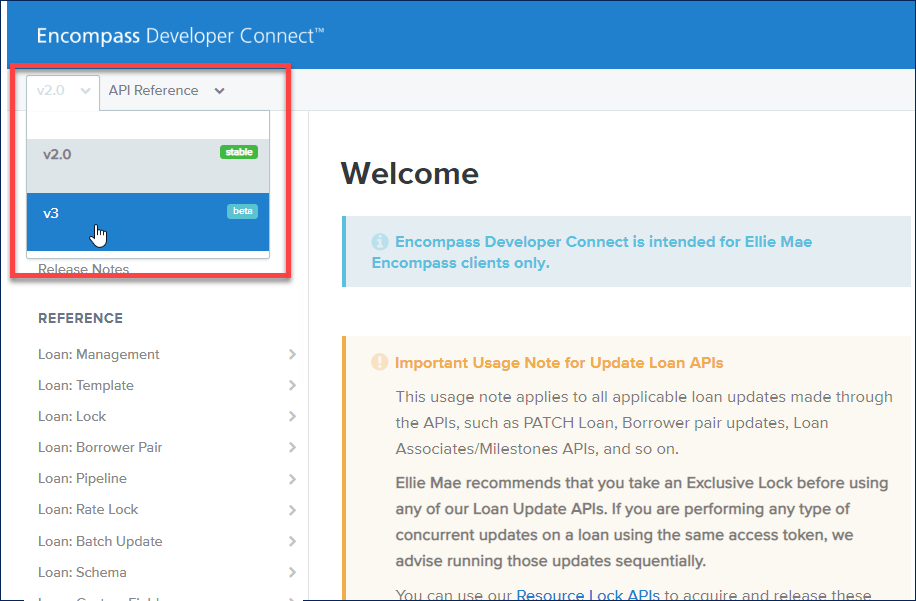

Introducing New Version 3 (V3) APIs

Early access to Encompass Developer Connect V3 APIs will be available in this release. The new and improved V3 APIs, which will be available under the "V3" section of the API Documentation can be used with the same oAuth token flow. The v3 APIs will simply have a new version in the API endpoints, and may have different data contracts from their v1 counterparts. V3 APIs ensure better performance, stability, ease of use and consistency for consuming the Developer Connect APIs. There will be a gradual roll-out plan for the v3 APIs.

Using V3 APIs to Manage Attachments and Documents

The V3 APIs utilize cloud storage for loan attachments. Cloud storage makes it possible to store and retrieve loan attachments faster, and requires less resources from the client workstation to process documents.

Enabling V3 Could Storage APIs for Early Access

The V3 Cloud Storage APIs will be generally available in 2020. For early access on Encompass 19.4 R2T Smart Client test environments, contact your Ellie Mae Relationship Manager.

Viewing Attachments in Encompass

Developer Connect V3 APIs work seamlessly with Encompass. Whether accessing attachments from the media server or cloud storage, the flow is the same with V3 APIs. With cloud storage, Encompass users will notice improved performance. They may also notice subtle changes in appearance to the Encompass eFolder and document viewer for new loans.

Using Both V1 and V3 APIs